Invoice to Income: Streamlining Billing and Payments with Contractor Invoicing Software

For many small contractors, the hardest part of running a business isn’t the work itself; it’s getting paid on time. You can deliver excellent service, finish jobs efficiently, and keep customers happy, yet still struggle with inconsistent cash flow because invoices go out late, payments come in slowly, or follow-ups fall through the cracks. This is where contractor invoicing software becomes more than a convenience; it becomes a critical business tool.

In today’s service economy, speed and simplicity matter. Customers expect clear invoices, multiple payment options, and frictionless transactions. Contractors, meanwhile, need reliable systems that reduce administrative work, prevent late payments, and provide real visibility into income. Streamlining billing and online payments for contractors isn’t about adopting fancy technology; it’s about building a predictable, professional income engine that supports growth.

This article explores how modern invoicing and payment systems transform the journey from completed job to collected income. We’ll look at the real billing challenges contractors face, how invoice automation improves cash flow, and why digital payments are now essential for small contracting businesses.

Table of Contents

ToggleThe Real Cost of Manual Invoicing for Small Contractors

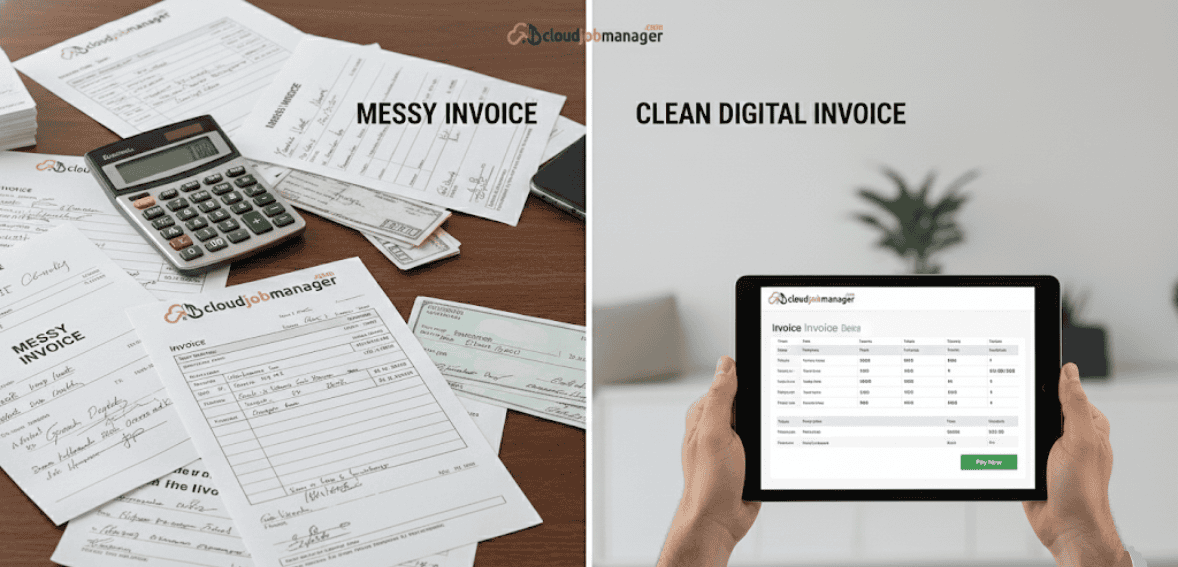

Many small contractors still rely on handwritten invoices, spreadsheets, or basic templates created after the job is finished, sometimes days later. While this may seem manageable early on, manual invoicing introduces delays and errors that directly impact income.

Every extra day between job completion and invoice delivery delays payment. Paper invoices get lost, emailed PDFs go unopened, and unclear descriptions cause disputes. Contractors underestimate the time spent chasing payments, correcting records, and resending invoices. This administrative work steadily reduces profit. Manual billing makes it difficult to spot patterns. Without a central system, it’s tough to know who pays late, which services bring in the most revenue, or how much revenue is tied up in unpaid invoices. These blind spots make cash flow unpredictable, a major stressor for small contractors.

Why Contractor Invoicing Software Changes the Game

Contractor invoicing software replaces scattered billing with a structured, automated workflow. Treat invoicing as part of the job, not an afterthought.

When invoices are generated directly from completed work orders, there’s no delay. Job details, labor hours, materials, and taxes are already captured, reducing errors and eliminating duplicate data entry. Invoices look professional, consistent, and easy for customers to understand, which significantly reduces disputes.

Billing software creates accountability. Every invoice gets a timestamp, status, and payment history. Contractors instantly see what’s been sent, what’s overdue, and what’s paid. This visibility turns invoicing into a proactive system.

How Invoice Automation Improves Cash Flow Consistency

One of the biggest advantages of modern invoicing systems is automation. Invoice automation ensures billing happens immediately, not when you “get around to it.”

Automated workflows generate and send invoices the moment a job is marked complete. Payment reminders can be scheduled automatically, reducing the need for awkward follow-up calls. Late fees or payment terms can be applied consistently, reinforcing professional boundaries without damaging customer relationships.

Over time, automation stabilizes cash flow. Instead of experiencing income spikes followed by dry periods, contractors gain a steadier stream of payments. This predictability makes it easier to cover operating expenses, pay technicians on time, and plan for growth.

Automation cuts the mental load. Contractors don’t need to remember who owes what the system does.

The Role of Online Payments for Contractors

Even the best invoice is only effective if customers can pay easily. Online payments for contractors are no longer optional; they’re an expectation.

Customers are far more likely to pay immediately when invoices include secure, one-click payment options. Credit cards, bank transfers, and digital wallets remove friction and excuses like “I’ll mail a check later.” When payments can be completed on a phone or laptop, delays drop dramatically.

From the contractor’s perspective, online payments accelerate income, reduce administrative work, and simplify reconciliation. Key benefits include faster payment processing, fewer manual recordkeeping tasks, and minimized accounting errors. This not only improves cash flow but also reduces end-of-month stress.

Online payments also enhance professionalism. Customers associate digital billing with organized, trustworthy businesses, which builds confidence and encourages repeat business.

Preventing Late Payments Before They Happen

Late payments are rarely about bad customers; they’re usually about unclear processes. Contractor invoicing software addresses this problem before it starts.

Clear terms, automatic reminders, and visible due dates set expectations. Customers know when and how to pay. This clarity avoids ambiguity and reduces the need for uncomfortable conversations later.

Many contractors discover that simply invoicing faster and offering online payment options significantly reduces late payments. When customers receive invoices promptly and can pay immediately, there’s no reason to delay.

Preventive systems are always more effective than reactive ones, and invoicing software is built around that principle.

Creating a Professional Billing Experience That Builds Trust

Billing isn’t just a financial process; it’s part of the customer experience. Inconsistent invoices, unclear charges, or delayed billing can undermine trust, even if the service itself was excellent.

Professional invoicing software creates consistency. Customers receive clean, branded invoices with itemized details and clear totals. Payment confirmations and receipts reinforce transparency, while automated communication keeps everything documented.

This professionalism matters. Customers pay promptly and return when confident in your processes. Smooth billing becomes a competitive advantage, especially for small contractors against larger firms.

Preparing Your Business for Scalable Growth

As a contracting business grows, billing complexity increases. More jobs, more customers, more technicians, and more opportunities for mistakes if systems don’t scale.

Contractor invoicing software grows with the business. Key benefits are accurate scaling, easier income tracking, and improved financial forecasting. Whether you’re managing five invoices a week or fifty a day, automation ensures accuracy without increasing workload. Income tracking becomes easier, forecasting improves, and financial decisions become more informed.

Most importantly, scalable billing systems free contractors to focus on what they do best delivering quality work instead of chasing payments.

Mobile Invoicing: Getting Paid While the Job Is Still Fresh

One of the biggest shifts in contractor billing over the last few years has been the move toward mobile invoicing. Instead of waiting until the end of the day or worse, the end of the week, contractors can now generate and send invoices directly from the job site. This single change has a powerful impact on cash flow.

When invoicing happens immediately after work is completed, customers are still mentally connected to the service they just received. They remember the value, the effort, and the result. Sending an invoice at that moment feels natural and justified, rather than delayed or disruptive. In contrast, late invoices often feel disconnected, which can subconsciously reduce a customer’s urgency to pay.

Mobile invoicing also reduces errors. Technicians can log labor hours, materials used, and notes in real time, rather than relying on memory later. This accuracy builds trust and minimizes disputes. When customers see detailed, timely invoices that match the work performed, they’re far less likely to question charges.

For small contractors, mobile invoicing turns every completed job into an immediate income opportunity rather than a future administrative task.

Real-Time Payment Tracking and Financial Visibility

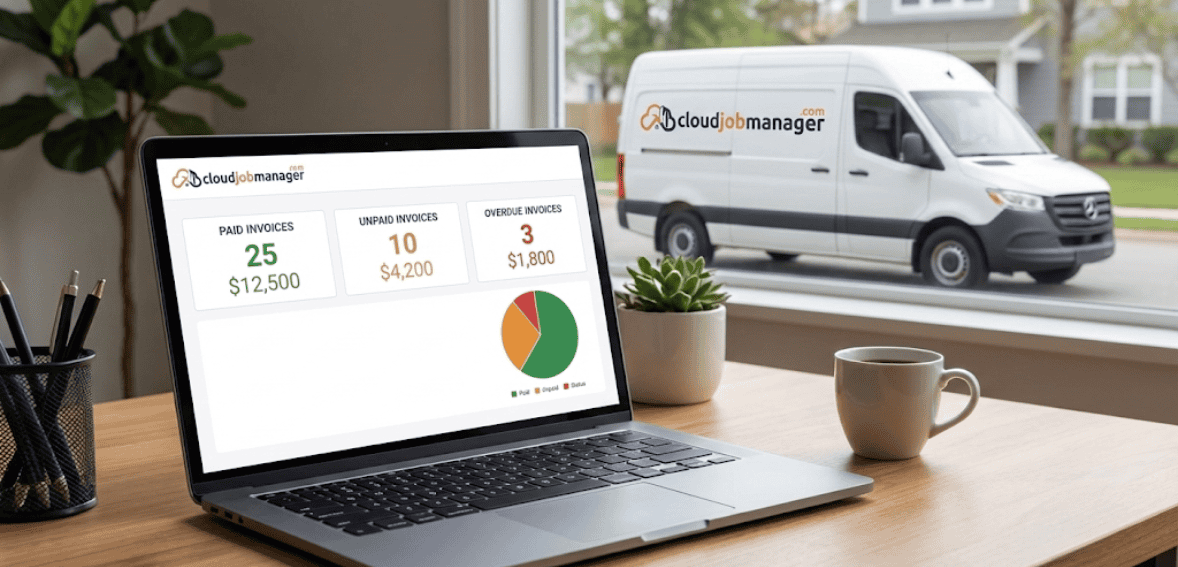

Knowing how much is owed and when it’s coming is critical for a healthy business. Yet many contractors lack real-time insight because their billing systems use outdated or incomplete information.

Modern contractor invoicing software offers live payment tracking. At any moment, you can see which invoices are paid, which are pending, and which are overdue. This visibility allows contractors to act quickly rather than react weeks later when cash flow tightens.

Real-time tracking also supports better decision-making. Contractors can forecast upcoming income, plan expenses more confidently, and avoid unnecessary borrowing. When you know exactly where your money stands, financial stress decreases and your sense of control increases.

Perhaps most importantly, payment visibility removes guesswork. Instead of blindly chasing customers, you can follow up strategically only when needed and always with accurate information.

How Invoice Automation Reduces Administrative Burnout

Administrative burnout is one of the most overlooked challenges in contracting businesses. Time spent invoicing, following up, correcting mistakes, and reconciling payments adds up quickly, and it often falls on the owner.

Invoice automation eliminates repetitive tasks. Once workflows are set up, invoices are created automatically, reminders are sent on schedule, and payment statuses are updated without manual input. This consistency saves hours every week.

Reducing administrative work doesn’t just save time; it preserves energy. Contractors who automate billing have more mental bandwidth to estimate jobs, manage teams, improve service quality, and grow their businesses. Automation isn’t about removing human involvement; it’s about removing unnecessary friction.

Over time, this reduction in workload can prevent burnout and make the business more sustainable.

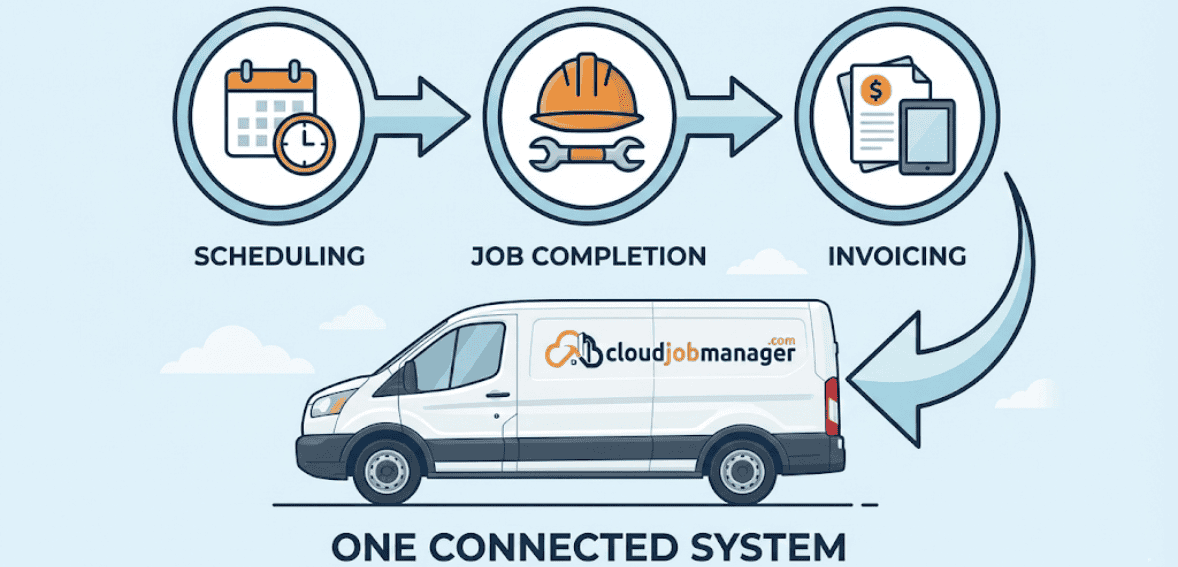

Integrating Billing with Field Service Operations

Billing works best when it’s not isolated. When invoicing integrates directly with scheduling, job tracking, and customer records, the entire operation runs more smoothly.

Integrated systems ensure invoices reflect actual work completed, not estimates or assumptions. Job completion triggers billing automatically, and payment records tie back to customer histories. This alignment reduces errors and creates a single source of truth.

Integration also improves accountability across the team. Technicians know that properly closing out a job leads directly to billing, reinforcing accurate documentation. Office staff no longer need to chase information, and customers receive faster, clearer invoices.

For growing contractors, integrated billing is essential for scaling without chaos.

Avoiding Common Invoicing Mistakes That Hurt Cash Flow

Even experienced contractors make billing mistakes that slow down revenue. Common issues include delayed invoicing, unclear descriptions, inconsistent payment terms, and insufficient follow-up. Individually, these may seem minor, but together, they create significant cash flow problems.

Contractor invoicing software addresses these issues systematically. Templates ensure consistency, automation enforces timing, and built-in reminders prevent invoices from being forgotten. Over time, these safeguards eliminate many of the small errors that quietly drain revenue.

Avoiding mistakes isn’t just about accuracy; it’s about professionalism. When billing feels organized and reliable, customers respond in kind.

Long-Term Financial Benefits of Streamlined Billing

The benefits of modern billing systems compound over time. Faster payments improve liquidity. Fewer disputes reduce lost revenue. Better visibility enables smarter planning. Together, these improvements strengthen the business’s financial foundation.

Contractors who streamline billing often find they can grow without adding administrative staff. The same systems that support a small operation can handle higher volume without additional overhead. This efficiency translates directly into higher profit margins.

In the long run, billing systems aren’t just about getting paid; they’re about building a business that’s resilient, scalable, and financially confident.

Conclusion: Turning Invoices into Income, Not Obstacles

Billing doesn’t have to be a pain point. With the right contractor invoicing software and online payments for contractors, invoicing becomes a predictable, streamlined process that supports growth instead of slowing it down.

When invoices go out on time, payments come in faster, and cash flow becomes steady, contractors gain more than money; they gain control. That control allows for better service, stronger customer relationships, and a healthier business overall.

From invoice to income, the path becomes clearer, faster, and far less stressful.

FAQs

How does contractor invoicing software improve cash flow?

It speeds up invoicing, enables online payments, and automates reminders, which reduces delays and late payments.

Are online payments really better than checks?

Yes. Online payments remove friction and allow customers to pay instantly, significantly reducing payment delays.

Is invoicing software worth it for very small contractors?

Absolutely. Even solo contractors save time, reduce errors, and look more professional with automated billing.

Can invoicing software help prevent disputes?

Clear, itemized invoices created from job data reduce misunderstandings and increase customer trust.

Does automation replace personal customer relationships?

No. Automation handles routine tasks, freeing you to spend more time on service and communication.