Quote-to-Cash: Streamlining Workflows from Estimates to Payment

Managing a service business today is no longer just about doing great work in the field. It’s about how efficiently you move from the moment a customer asks for a quote to the moment payment hits your account. This entire journey is known as the quote-to-cash process, and for many field service businesses, it’s where profits are either protected or quietly leaked.

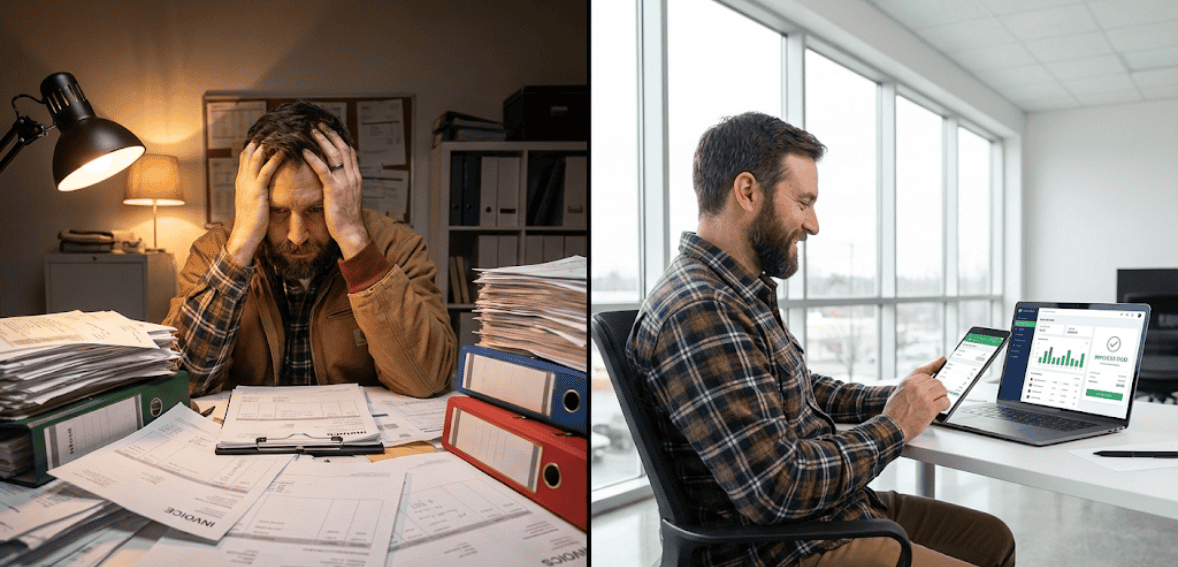

When the quote-to-cash process is fragmented, jobs stall, invoices go out late, payments drag on, and teams waste hours fixing preventable mistakes. But when the quote-to-cash process is streamlined through proper job lifecycle management, businesses gain clarity, speed, and financial control across every job.

This article explores how field service management companies can streamline workflows from estimates to payment using an integrated, end-to-end approach. We’ll look at where breakdowns usually happen, why job lifecycle management matters, and how aligning estimates, scheduling, job execution, invoicing, and payment collection transforms both cash flow and customer experience.

Table of Contents

ToggleWhy the Quote to Cash Process Is the Backbone of Job Lifecycle Management

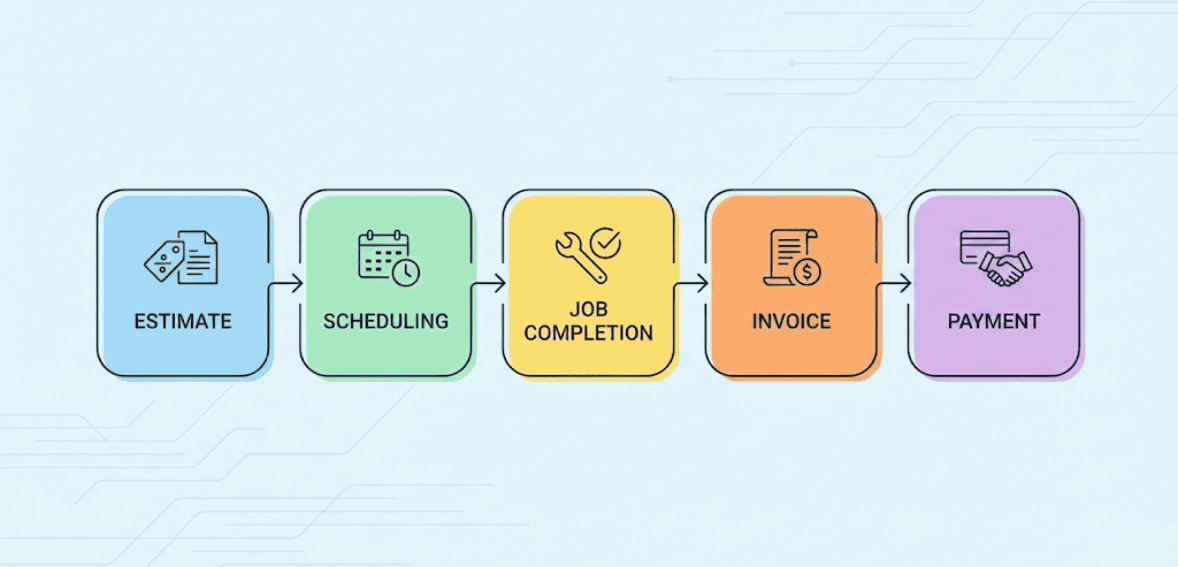

The quote-to-cash process is not a single task; it’s a connected system. It begins when a customer requests an estimate and ends when the job is completed, invoiced, and paid. Every step in between affects revenue timing, accuracy, and customer satisfaction.

In businesses without strong job lifecycle management, each stage is often handled in isolation. Estimates live in one system, schedules in another, job details on paper, invoices in spreadsheets, and payments somewhere else entirely. This fragmentation creates delays, inconsistencies and confusion for staff and customers.

Effective job lifecycle management ensures that information flows automatically from one stage to the next. When a quote is approved, it becomes a job. When a job is completed, it triggers invoicing. When an invoice is sent, payment options are immediately available. Nothing is re-entered manually, nothing is forgotten, and nothing gets lost.

A well-managed quote-to-cash process gives business owners real-time visibility into revenue, job status, and outstanding payments. It replaces guesswork with certainty and transforms daily operations from reactive to controlled.

Where the Quote to Cash Process Commonly Breaks Down

Many field service businesses believe their biggest problems are labor shortages or rising costs. In reality, inefficiencies in the quote-to-cash process often have a larger financial impact.

One of the most common issues occurs at the estimating stage. Quotes may be delayed, inconsistent, or inaccurate. Sales teams may send estimates without standardized pricing, leading to disputes later. In some cases, approved quotes aren’t clearly tracked, resulting in missed follow-ups and lost jobs.

The next breakdown typically happens when quotes are approved but not smoothly converted into scheduled jobs. Without proper job lifecycle management, office staff must manually re-enter job details, increasing the risk of errors or delays. A job that should be scheduled immediately may sit idle for days simply because the workflow isn’t connected.

Execution in the field introduces another layer of risk. If technicians don’t have access to the original estimate details, scope creep becomes common. Work may go unbillable, or tasks may be skipped because expectations weren’t clear.

Finally, invoicing and payment collection are often the most affected. Invoices are sent late, lack detail, or don’t match the original estimate. Customers hesitate to pay, disputes arise, and cash flow slows. Each of these issues stems from a disconnected quote-to-cash process.

The Role of Estimating Software in a Modern Quote to Cash Process

Estimating is the foundation of the entire sales-to-payment cycle. If the estimate is unclear, inaccurate, or disconnected from later stages, every downstream process suffers.

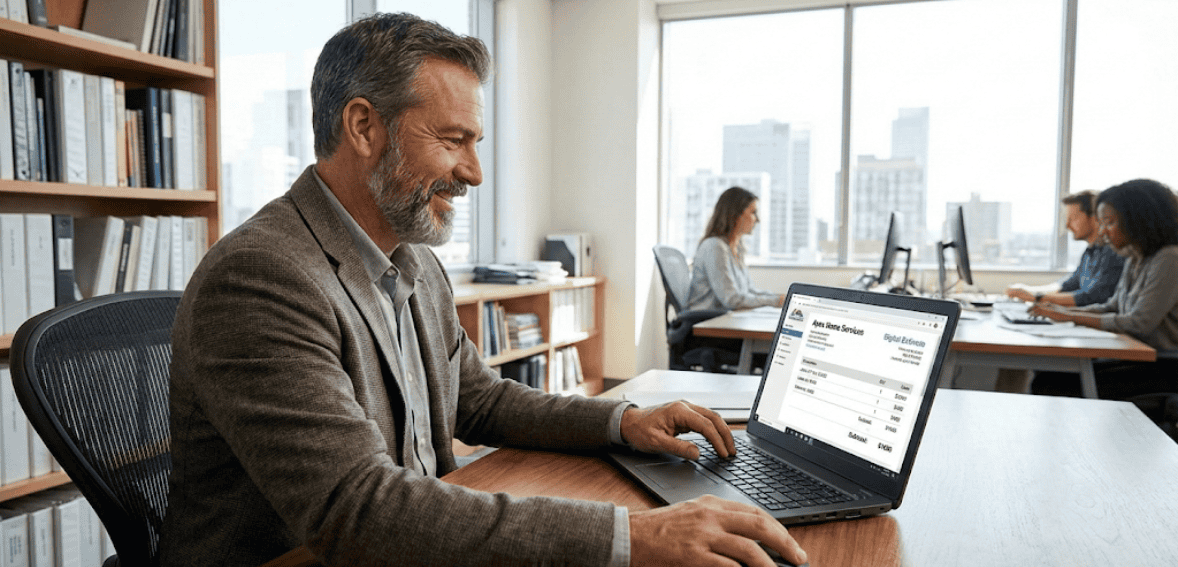

Modern estimating software plays a critical role in strengthening the quote-to-cash process. Instead of static documents or handwritten quotes, digital estimates create structured data that flows through the job lifecycle. Pricing, labor, materials, and terms are all captured in a standardized format.

This structure matters. When an estimate is approved, the system doesn’t just record a “yes,” it activates the next stage of job lifecycle management. The approved estimate becomes the job blueprint. Technicians know exactly what was sold. Office teams know what to schedule. Invoicing knows what to bill.

Estimating software also improves speed and professionalism. Quotes can be generated quickly, sent digitally, and approved online. Faster estimates lead to faster approvals, accelerating the entire quote-to-cash process and shortening the time between customer interest and revenue realization.

Job Lifecycle Management Begins the Moment a Quote Is Approved

Approval is a pivotal moment in the quote-to-cash process. It’s were sales transitions into operations. Without strong job lifecycle management, this transition is often clumsy and inefficient.

In a streamlined system, approval automatically triggers job creation. The approved scope, pricing, and customer information move seamlessly into scheduling. There’s no need for duplicate data entry, and no risk of losing critical details.

This connection between estimating and job creation ensures continuity. The job lifecycle is clearly defined from the start, with expectations aligned across sales, operations, and billing. Everyone is working from the same source of truth.

Effective job lifecycle management also ensures accountability. Jobs are tracked from approval through completion, making it easy to see where work stands and what remains outstanding. This visibility is essential for scaling operations without losing control.

Scheduling as a Critical Link in the Sales to Payment Cycle

Scheduling is more than assigning a date and time; it’s a bridge between promise and delivery. In the quote-to-cash process, poor scheduling can undo even the best estimates.

When scheduling isn’t integrated into job lifecycle management, delays creep in. Approved jobs may wait too long to be scheduled, or technicians may arrive without the correct job details. Both scenarios damage customer trust and delay payment.

Integrated scheduling ensures that once a quote is approved, the job moves immediately into execution planning. Availability, location, and job requirements are considered together. Technicians receive complete job information, including the original estimate, before they ever arrive on-site.

This alignment reduces rescheduling, improves first-time completion rates, and keeps the quote-to-cash process moving forward without interruption. The faster and smoother the job execution, the faster invoicing and payment can follow.

Why End-to-End Field Service Workflows Protect Revenue

The real power of a streamlined quote-to-cash process lies in its continuity. End-to-end field service workflows eliminate handoffs, gaps, and delays that quietly drain revenue.

When estimating software, scheduling, job execution, invoicing, and payments are integrated, each stage reinforces the next. There’s no ambiguity about what was sold, what was done, or what should be paid.

This integration also improves customer confidence. Customers see consistency from estimate to invoice, reducing disputes and accelerating payments. Clear workflows create a professional experience that builds trust and encourages repeat business.

From a financial perspective, end-to-end job lifecycle management shortens the sales-to-payment cycle. Revenue moves faster, cash flow stabilizes, and businesses gain the predictability needed to grow.

Invoicing as the Turning Point in the Quote to Cash Process

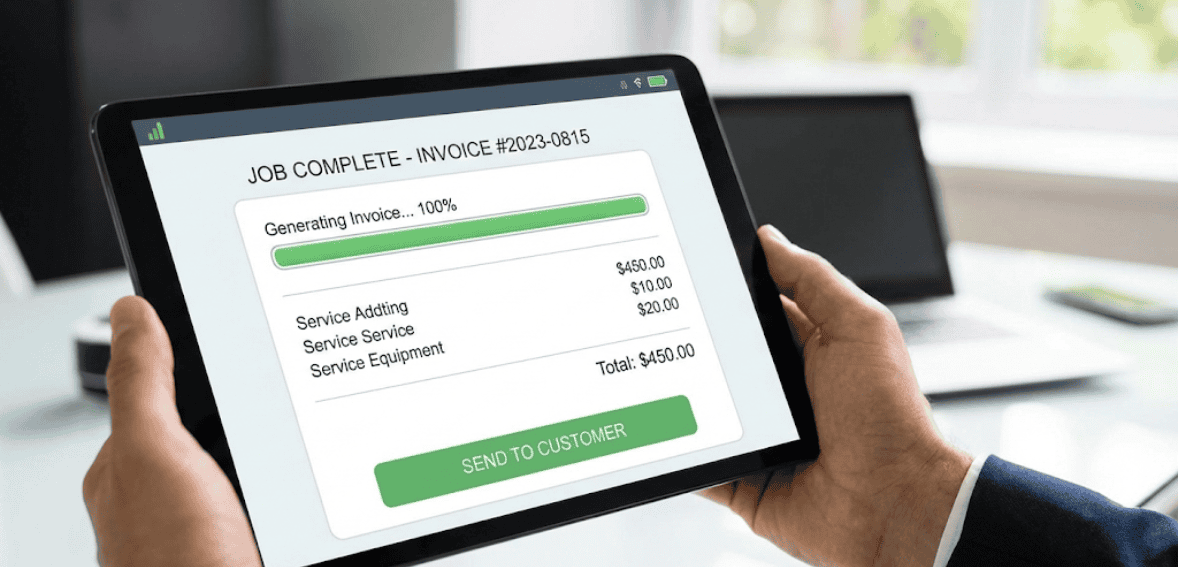

Invoicing is where many service businesses unintentionally slow down their own cash flow. Even after a job is completed perfectly, revenue can sit uncollected simply because invoicing is delayed, unclear, or disconnected from earlier stages of the job lifecycle.

In a fragmented setup, invoices are often created manually after the job, sometimes days or weeks later. Details may be missing, pricing may not match the original estimate, and customers may question charges they don’t recognize. Each of these issues creates friction, and friction delays payment.

When invoicing is fully integrated into the quote-to-cash process, it becomes automatic rather than reactive. Once a job is marked complete, the invoice is generated directly from the original estimate and job data. Labor, materials, taxes, and discounts are already aligned. Nothing has to be rebuilt from scratch.

This alignment is one of the most powerful advantages of strong job lifecycle management. It ensures that what was quoted, what was delivered, and what is billed all match perfectly. That consistency builds trust and dramatically reduces invoice disputes.

Why Job Management Integration Speeds Up the Sales to Payment Cycle

Job management integration is what turns separate tools into a single operational system. Without it, the quote-to-cash process becomes a relay race in which information is passed manually from stage to stage. With integration, the process becomes a continuous flow.

When estimating, scheduling, job execution, and invoicing all live in one connected workflow, time is no longer wasted moving information between systems. Updates made in the field are reflected immediately in the office. Completed work instantly triggers billing. Payment status updates flow back into reporting.

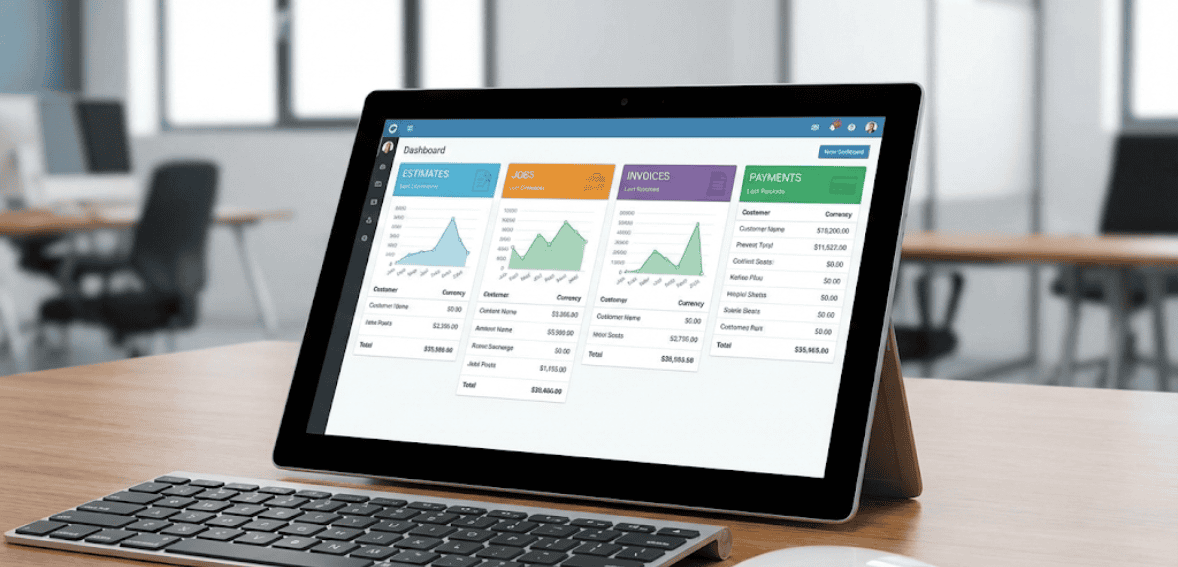

This real-time visibility is essential for effectively managing the sales-to-payment cycle. Business owners can see which jobs are quoted, approved, in progress, invoiced, or paid, all at a glance. That insight allows faster decisions and proactive follow-ups.

Integrated job lifecycle management also reduces human error. Duplicate data entry disappears. Missed invoices become rare. And financial forecasting becomes more accurate because revenue isn’t trapped in operational bottlenecks.

Online Payments and Their Impact on Cash Flow Timing

Even the best invoicing process fails if customers can’t pay easily. In today’s environment, customers expect fast, digital payment options. If payment requires extra steps, delays are almost guaranteed.

Online payments are a critical extension of the quote-to-cash process. When invoices include immediate payment options, the distance between service completion and cash receipt shrinks dramatically. Customers are far more likely to pay when the option is right in front of them.

From a job lifecycle management perspective, integrated payments close the loop. The job isn’t just completed and billed, it’s financially resolved. Payment confirmation automatically updates the job record, keeping financial reporting accurate and up to date.

Faster payments improve more than cash flow. They reduce administrative overhead, minimize follow-ups, and improve customer satisfaction. Customers appreciate clear, simple billing, and businesses benefit from predictable revenue timing.

Common Quote to Cash Mistakes That Quietly Drain Revenue

Even businesses with good intentions often make small mistakes that weaken their quote-to-cash process. Over time, these mistakes compound into serious financial inefficiencies.

One of the most common errors is treating each stage as separate. When estimating, scheduling, and billing don’t communicate with each other, inconsistencies arise. Another frequent issue is delaying invoicing, which sends an unintended signal that payment urgency is low.

Poor communication between field teams and the office is another major problem. If technicians don’t capture job details accurately, invoices may be incomplete or incorrect. That leads to disputes, rework, and delayed payments.

Finally, many businesses fail to track their sales-to-payment-cycle metrics. Without knowing how long it takes to move from quote approval to payment, it’s impossible to identify bottlenecks or measure improvement.

Strong job lifecycle management addresses all of these issues by creating a structured, transparent workflow that keeps revenue moving forward.

Best Practices for Streamlining End-to-End Field Service Workflows

A healthy quote-to-cash process doesn’t happen by accident; it’s intentionally designed. Successful service businesses follow a few core principles to keep workflows efficient and predictable.

First, they standardize estimates. Consistent pricing structures and clear scopes reduce confusion later. Second, they automate transitions between stages. Approved quotes become jobs, completed jobs become invoices, and invoices include payment options automatically.

They also empower field teams with the right tools. When technicians can update job status, add notes, and capture photos in real time, billing accuracy improves significantly. The job lifecycle stays intact from start to finish.

Finally, they regularly review their sales against the payment cycle. Metrics like time-to-invoice and days-to-payment provide insight into where improvements are needed. Continuous refinement keeps the quote-to-cash process resilient as the business grows.

How a Streamlined Quote to Cash Process Supports Long-Term Growth

Growth magnifies inefficiencies. A process that feels manageable with a few jobs per week can collapse under higher volume. That’s why scalable job lifecycle management is essential for sustainable expansion.

A streamlined quote-to-cash process allows businesses to handle more jobs without adding administrative burden. Automation absorbs the extra workload. Integration prevents chaos. And real-time visibility keeps leadership in control.

As businesses grow, customer expectations also increase. Fast quotes, clear communication, and simple payments become non-negotiable. A strong sales-to-payment cycle meets those expectations while protecting margins.

Ultimately, the quote-to-cash process isn’t just an operational concern, it’s a strategic asset. Businesses that master it gain financial stability, operational confidence, and a foundation for long-term success.

Conclusion: Turning Quotes into Reliable Cash Flow

The journey from estimate to payment defines the financial health of a field service business. When the quote-to-cash process is fragmented, revenue leaks quietly through delays, errors, and missed opportunities. When it’s unified through strong job lifecycle management, cash flow becomes predictable and controllable.

By integrating estimating software, scheduling, job execution, invoicing, and online payments into a single workflow, businesses eliminate friction at every stage. The sales-to-payment cycle shortens, customer trust improves, and teams spend less time chasing money and more time delivering value.

Mastering the quote to cash process is not about working harder, it’s about designing smarter workflows that let revenue move as efficiently as the work itself.

FAQs

What is the quote-to-cash process in field service businesses?

The quote-to-cash process covers everything from creating an estimate to collecting payment. It includes estimating, job scheduling, execution, invoicing, and payment collection as one continuous workflow.

Why is job lifecycle management important for cash flow?

Job lifecycle management ensures that every stage of a job is connected. This prevents delays, billing errors, and missed invoices, helping businesses get paid faster and more consistently.

How does integration improve the sales-to-payment cycle?

Integration removes manual handoffs between systems. Approved quotes become jobs automatically, completed jobs trigger invoices, and payments update records instantly, speeding up the entire cycle.

What causes delays in the quote-to-cash process?

Common causes include manual invoicing, disconnected systems, poor field documentation, and a lack of online payment options. Each adds friction that slows payment.

Can small service businesses benefit from streamlining the quote-to-cash process?

Absolutely. Even small teams see faster payments, fewer disputes, and less admin work when their quote-to-cash process is well-structured and automated.