The Power of Online Payments and Invoicing for Field Service Cash Flow

Managing cash flow is one of the toughest challenges for field service companies, regardless of size or industry. From HVAC and plumbing to electrical, landscaping, appliance repair, pest control, and beyond, every service business relies heavily on payment timing to stay operational. When invoices are mailed out days after a job, customers delay payment, or checks get lost in transit, the business feels the strain almost immediately. Wages, fuel, equipment, parts, subscriptions, and marketing bills do not wait, and when payments lag, owners are often forced to make difficult decisions or borrow money to bridge the gap. That’s where online payments in field service operations become a transformative tool rather than a convenience.

Digital invoicing and online payment options transform a business’s financial rhythm, replacing unpredictable cycles with speed, accuracy, and efficiency.

There is a noticeable shift in the service industry. Customers expect faster, easier and reliable ways to pay. Businesses need smooth billing workflows that reduce manual tasks and accelerate cash coming into the bank. Online payment systems meet both needs simultaneously. They close the gap between completed work and collected revenue, reduce administrative chaos, eliminate paperwork dependencies, and build more professional and trustworthy customer relationships. When cash flow improves, everything else becomes easier. Planning, purchasing, staffing, and growing.

Companies that adopt digital invoicing early tend to scale faster than those that rely on traditional billing. Paper-based and manual systems create bottlenecks that limit growth. Digital systems remove those barriers, allowing businesses to take on more clients and more work without financial friction. This article explores why online payments in field service are becoming essential, how they solve old problems, and why embracing digital invoicing is one of the most intelligent financial decisions a contractor or service business can make.

Table of Contents

ToggleThe Hidden Cost of Traditional Billing Methods

For decades, many service businesses relied on handwritten invoices, mailed paper statements, or verbal agreements to defer payment. While this approach was once common, it is becoming increasingly impractical in today’s faster, more digitally oriented world. Traditional billing processes are inherently slow and fragile because they depend on multiple manual steps: creating the invoice, delivering it, waiting for the customer to receive it, hoping they pay promptly, and then manually recording the payment when it finally arrives. Every step introduces delays and risk.

Paper invoices can be misplaced, damaged, or ignored. Customers may forget to send payment or unintentionally push the invoice aside in a pile of responsibilities. If a business has to mail invoices, there is yet another waiting period during which cash that should already be available is stuck in transit. Even worse, it often falls to office staff to chase overdue payments, make phone calls, send reminders, and match records across multiple systems. All this is time-consuming and expensive, and it drains energy from productive work.

This financial strain compounds in businesses with high job volume. A single cancellation or unpaid invoice at the wrong time can disrupt payroll or supply orders. The stress is constant: owners wait, technicians complete more jobs without seeing revenue, and the business becomes reactive instead of controlled. When 80-90% of companies report late invoice payments in many industries, the reality is apparent traditional billing systems prolong financial uncertainty.

Digital payments directly address these weaknesses by eliminating waiting periods in favor of instant processing. Instead of relying on memory, paper trails, or trust, payments are made reliably at the end of the job or shortly thereafter. This shift alone changes the financial heartbeat of a business.

How Online Invoicing Speeds Up the Payment Cycle

The most significant advantage of online invoicing for contractors is speed. When a job is finished, and an invoice is generated on the spot whether via mobile device, tablet, or cloud software, customers can review the breakdown immediately and pay right away from their phone or card. There is no delay between service completion and billing. The payment process becomes friction-free, and customers respond faster because they have no additional steps to complete later.

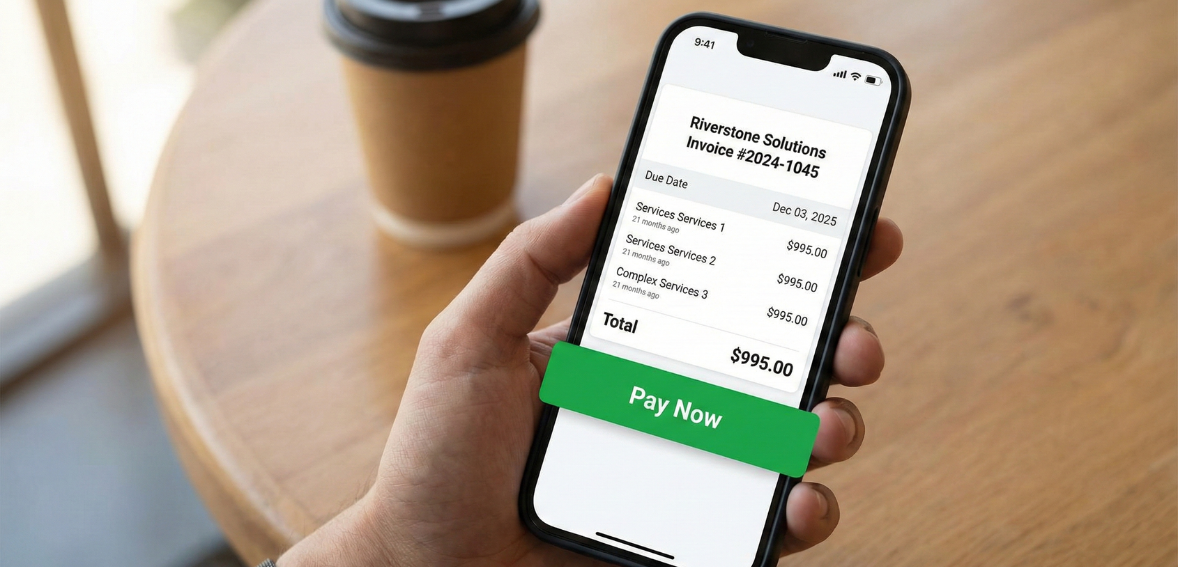

Modern digital invoices often include a secure “Pay Now” button that connects directly to a payment portal. When the customer receives the invoice by email or text, they can pay instantly with a card, an ACH transfer, or another digital method. Because it is so convenient, the rate of immediate payment is dramatically higher. Instead of waiting weeks for a check, funds become available within minutes or hours. Automatic payment confirmation also ensures accurate records without manual entry.

The professionalism factor matters as well. Digital invoices are clear, clean, itemized, branded, and properly formatted. Customers trust businesses that appear organized and efficient. When a service company offers transparency and convenience, customers are far more willing to pay promptly and recommend the business to others. Online invoicing isn’t just a financial tool it enhances credibility and customer perception.

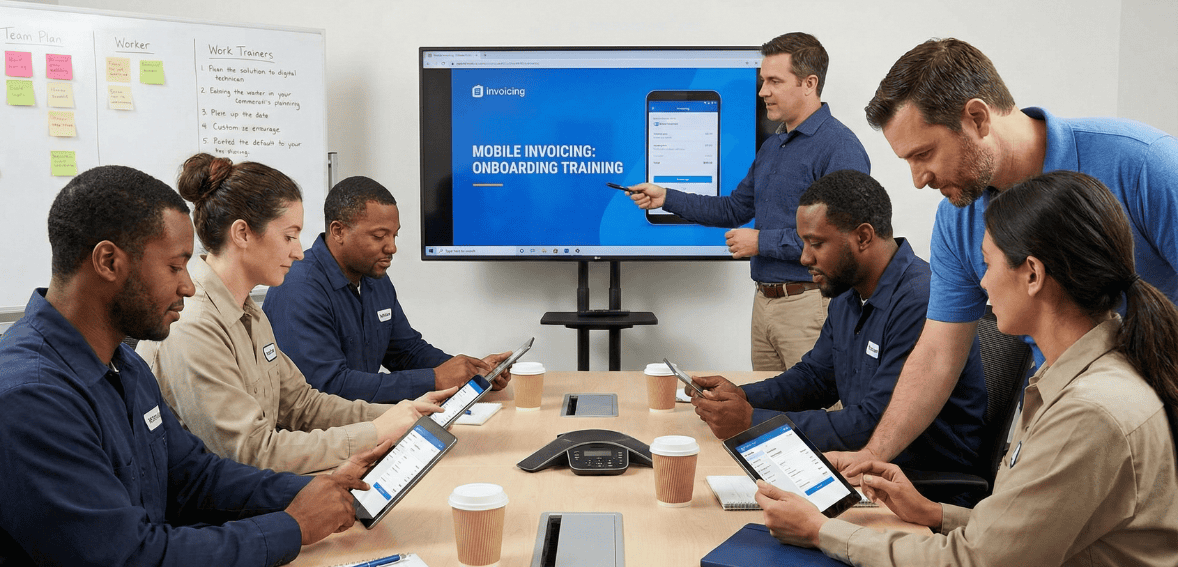

Mobile Payment Options and Onsite Processing

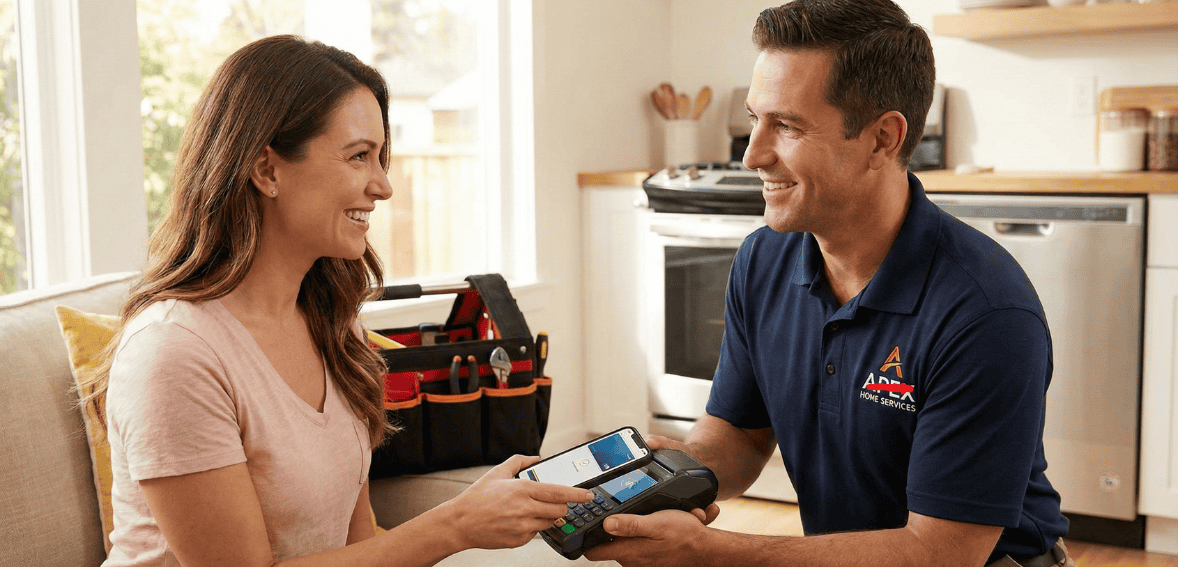

One of the most potent developments in field service billing is the ability to accept payments in the field rather than wait for office processing. When technicians can take payments at the job site using mobile card readers, tap-to-pay systems, or digital payment applications, the revenue cycle shortens dramatically. Payments can be collected before the technician even leaves the driveway, nearly eliminating past-due invoices and eliminating the need for follow-up collection calls.

For technicians, this process is easy and fast. They complete the job, review the service summary with the customer, and present a digital invoice right there. The customer can swipe, tap, or enter card information securely. The system automatically records the payment, generates an electronic receipt, and updates accounting records, so no manual data entry is required later. The time saved can be redirected toward scheduling more jobs and improving service delivery, rather than bureaucratic tasks.

Online payments also protect businesses from uncertainty. When jobs require costly parts or emergency service, collecting payment immediately ensures that the company is never financing the work on behalf of the customer. Even if a customer prefers to pay in cash or by check, the digital system can record the transaction and capture a signature instantly, ensuring consistent records.

Mobile point-of-sale capabilities turn payment into a seamless part of the customer experience rather than an afterthought that must be hunted down later. It is simple, reliable, and profoundly effective for improving field service cash flow, especially for businesses operating on thin margins or high operational expenses.

Reducing Administrative Burden and Improving Efficiency

Beyond speed, online payments transform internal operations. Traditional billing requires manual logging, physical document handling, and reconciliation of multiple systems. Digital invoicing eliminates all of that. Because invoices, payments, and job records are automatically linked within the same platform, staff no longer spend hours updating spreadsheets, verifying ledger entries, or searching for missing paperwork. Time once wasted becomes available for service, sales, and customer retention.

Automation also reduces the likelihood of costly mistakes. Incorrect invoice amounts, duplicate charges, misplaced payments, mismatched totals, and lost receipts are all common under manual systems. Digital systems provide accuracy by design, minimizing human error and ensuring every transaction is traceable. Recordkeeping also becomes effortless if needed, payment history can be retrieved instantly without digging through folders or file cabinets.

The ability to automate payment reminders is another decisive advantage. Instead of manually contacting customers about unpaid invoices, businesses can set automated follow-ups to go out after a specified number of days. Customers appreciate reminders, especially when they are friendly and professional. These follow-ups prevent embarrassment, confusion, and conflict because customers receive consistent communication before issues escalate.

For office teams, automation reduces stress and workload. For technicians, seamless billing means fewer interruptions. And for business owners, it means less time worrying about receivables and more time focusing on growth. Online payments in field service remove inefficiency and free up mental and operational bandwidth.

Customer Convenience and the Modern Payment Experience

One of the most significant drivers of online payments adoption in the field service is simply changing customer behavior. People expect convenience in every aspect of their lives now whether ordering food, booking an Uber, shopping online, or paying bills with a tap. The idea of writing a check, finding an envelope, buying stamps, and mailing the payment feels outdated and inconvenient compared to a single click. When service businesses offer digital payment options, they meet customers where they already are. This level of convenience makes customers feel respected, valued, and supported, and it dramatically increases their willingness to pay promptly.

Convenience also reduces friction. When customers can review an invoice instantly and pay with stored payment methods, they don’t have to search for card information or plan to handle payment later. Many customers prefer a service that feels fast and organized. When everything goes smoothly, customers leave the job feeling confident that they chose the right company. That satisfaction becomes loyalty, and loyalty becomes repeat business. Something as simple as a clean, instant payment experience can be the difference between a one-time repair call and a long-term maintenance relationship.

The world of service businesses has evolved rapidly over the past decade, with digital transformation reshaping how customers interact with companies. Today, convenience is king, and businesses that fail to adapt risk being left behind. Whether you’re a home services provider, independent contractor, or part of a larger field service companies elevating customer experience with online scheduling and online payments and it’s is no longer a luxury. It’s an expectation.

The Real Financial Impact on Cash Flow

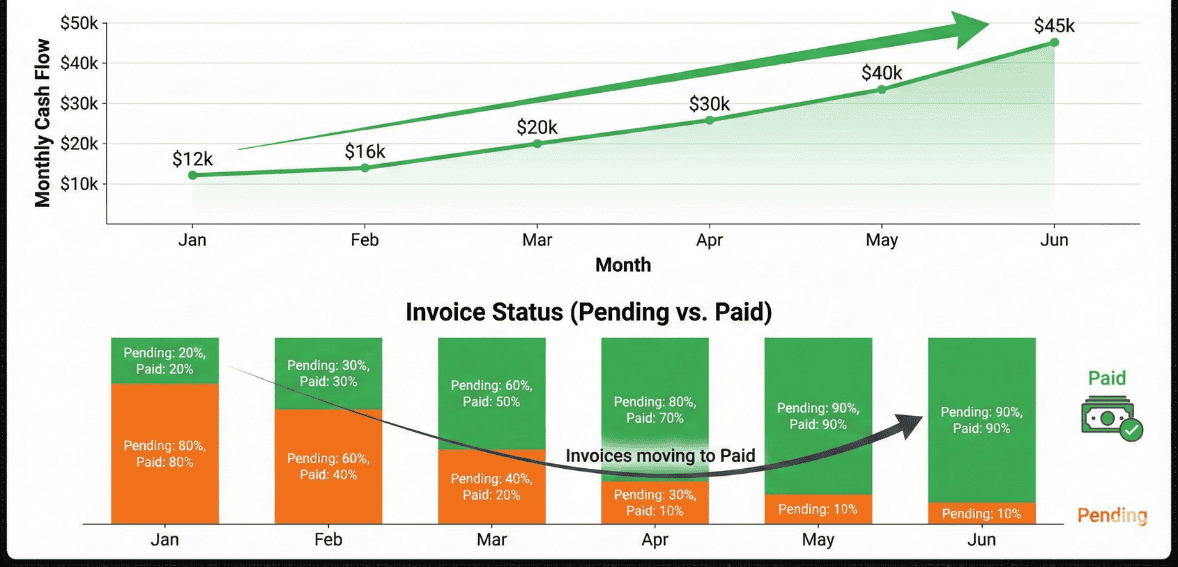

Cash flow is the foundation of stability in the field service world. It determines whether a company can buy materials without hesitation, hire additional technicians, invest in new equipment, handle seasonal fluctuations, or confidently accept opportunities rather than fear risk. When payments are delayed, things slow. Work continues, but revenue does not keep up with expenses, leaving business owners to juggle bills or chase customers to stay current. That stress takes energy from growth and innovation.

Online payments change that dynamic. When money arrives the same day the work is completed, owners gain control and predictability. Instead of guessing when checks will arrive, deposits occur consistently and automatically. That steadiness allows better planning, weekly forecasting becomes more accurate, emergency expenses feel less threatening, and decision-making becomes proactive instead of reactive. A business that gets paid fast moves with confidence.

Cash flow also impacts morale. When technicians know they are working for a financially strong company, they feel secure. When payments are late, pressure rises across the team, owners carry anxiety, technicians worry about hours, and managers experience tension as they try to balance the numbers. Getting paid quickly, rather than waiting weeks, eliminates that emotional burden. In simple terms: faster payments make stronger businesses, and stronger businesses make happier teams.

Choosing the Right Digital Payment System

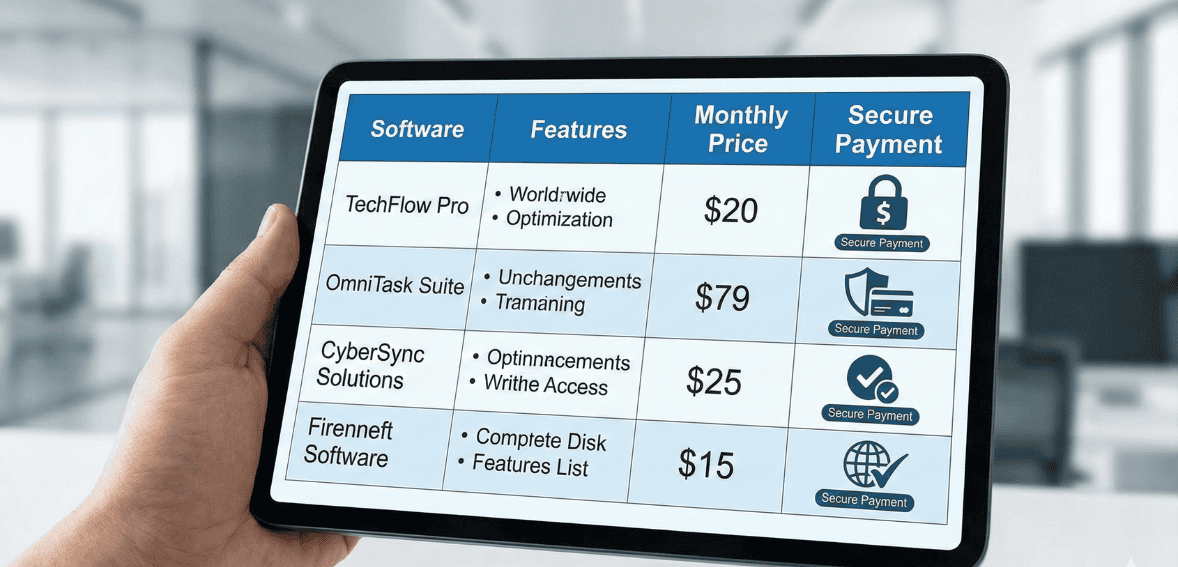

Transitioning to online payments for field service is not only about technology; it is about choosing tools that integrate naturally into existing workflows. The right system should feel intuitive for technicians, easy for customers to use, and reliable for financial tracking. A good payment solution allows businesses to create and send invoices instantly, accept payments onsite or remotely, and automatically record transactions without manual entry. It should support multiple payment types, including credit cards and bank transfers, and provide transparent reporting for reconciliation and accounting.

Security is essential. A trustworthy system encrypts data, follows compliance requirements, and protects both the business and the customer. Technicians should never handle sensitive information directly or manually store card numbers. When security is built into the process, it builds trust and reduces financial liability.

Integration also matters. A strong payment platform should connect seamlessly with scheduling, job management, and accounting systems. When software communicates smoothly, the business runs as a unified structure rather than as disconnected pieces. A system that automates invoicing, reminders, receipts, and ledger entries can eliminate hours of weekly administrative work. The right digital payment environment becomes part of the operation, rather than an extra task layered on top.

Transitioning Smoothly to Digital Billing

Many business owners hesitate to implement change because they worry that switching to a new system will be disruptive or that customers won’t adapt. In reality, most service teams and customers transition easily when the process is introduced clearly and consistently. The shift doesn’t have to happen overnight; it can start with offering online payment options alongside traditional ones, then gradually emphasizing digital tools as the primary choice. The key is communication explaining why the change benefits everyone.

Training technicians to present invoices confidently at the job site builds trust and sets clear expectations. Teaching office staff to use a digital dashboard prevents disorganization. Communicating with customers that digital invoicing improves transparency and provides secure receipts reassures them that the transition supports their convenience, not the company’s convenience alone. When the switch is framed as a value upgrade, customers embrace it rather than resist it.

As systems settle into place, the business quickly sees results: fewer unpaid invoices, fewer phone calls dedicated to collections, fewer hours lost to paperwork, and less financial stress each month. The change feels less like installing new software and more like gaining a smoother path forward.

Conclusion

A service company’s strength is directly tied to its cash flow. No amount of skill, talent, or hard work can overcome the constant pressure of delayed payment cycles. Moving to online payments in field service transforms the way companies operate replacing uncertainty with stability, replacing administrative chaos with automated structure, and replacing stressful collection processes with seamless professional efficiency. It removes obstacles that hold businesses back and creates new growth opportunities.

When customers pay quickly and easily, businesses thrive. When payment delays disappear, planning and expansion become realistic goals. Digital payments are more than just technology; they are a strategic advantage. The businesses that adopt them build long-term strength, stability, and competitive edge.

FAQs

How do online payments improve cash flow for field service companies?

Because invoices are sent and paid instantly, revenue arrives much faster, reducing wait times and eliminating the lengthy delays associated with mailed checks or follow-up collections. Faster payments mean more predictable income and healthier financial planning.

Is it secure to accept payments digitally or on the job site?

Yes. Modern payment systems use encryption and compliance standards to protect sensitive card data. Technicians never store or manually handle card numbers, and transactions are processed securely through approved systems.

Can online invoicing reduce late payments?

Definitely, instant invoice delivery, automated reminders, and the ability to pay with one click all dramatically reduce forgetfulness and delays. When paying becomes easy, customers respond faster.

What if some customers prefer traditional payment methods?

Businesses can still accept cash or checks when necessary while recording them digitally to maintain accurate records. Over time, customers naturally migrate toward the convenience of online payment options.

Do transaction fees outweigh the benefits?

For most businesses, the speed and reliability of faster payments far outweigh the small processing fee. It reduces the risk of non-payment and improves cash flow, which is often worth far more than the fee itself.